2021 Predictions: Sportsbook Content Strategy for the $60 Billion Online Gambling Market

2021 PREDICTION: Sports betting operators will re-think content investment in order to drive higher lifetime values of newly acquired customers. Increased focus will be on content-driven betting experiences VS just user acquisition.

The “Sportsbook Wars” of 2020 were defined by two words: user acquisition. Just like the “Streaming Wars”, “Podcast Wars”, and “Food Delivery Wars”.

Like OTT video, podcasts, or online food delivery, online sports betting is a nascent yet rapidly growing market with great revenue potential and minimal product differentiation. Specifically, the US online gambling market is expected to realize a 15% CAGR between 2020 and 2025, at which point it’s projected that 75% of all US sports betting revenues will come from bets placed online. And the online gambling market is expected to be $20 billion by 2025, $40 billion by 2030, and it’s long-term potential is valued at $60 billion.

And just like sportsbooks’ 2020 gameplan, the prevailing strategy of the well-capitalized combatants across all of these “Wars” is simple: win the land grab.

Spend aggressively to win market share today, while the market is in its formative stages and consumers are developing their routines, in order to become the default user destination for years to come.

One key metric companies use to evaluate their marketing effectiveness is the customer-level ratio of lifetime value to cost of acquisition. For example, DraftKings’ LTV / CAC ratio is $2,500 to $371.

Much like we’ve seen in the “Streaming Wars”, where the top 6 streamers spent a combined $5+ billion on marketing in 2020, online sportsbooks have been on a spending spree to acquire critical early stage market share. Advertising spend by sports betting brands increased by 82% YoY in 2020. FanDuel, DraftKings, and Bet365 have spent over $200 million on advertising since June 2020.

The guiding principle of these advertising initiatives has been to maximize customer acquisition by maximizing reach. Casting the widest possible net to drive as many new signups as possible.

90% of 2020’s sports betting ad spend went to TV broadcasters, who’s primary asset is scaled reach. And each of the major TV networks, as well as most pro sports teams, have signed lucrative partnership deals with a major betting operator, several of which are reported to be worth nine figures. These include CBS / William Hill, NBCU / PointsBet, Fox / Stars Group, Turner / DraftKings + FanDuel, ESPN / Caesars, New York Knicks, Rangers, Giants / DraftKings, and more.

However, we believe this approach of pursuing broad reach and user acquisition at all costs must be reevaluated in 2021.

In Q3 2020, DraftKings lost nearly $348 million, after tripling its “sales and marketing costs”. Further, the company’s average revenue per user (“ARPU”) declined.

This performance signals that competitive pressures could be escalating faster than expected. The aggressive “top-of-funnel” marketing approach isn’t sustainable, even for behemoths like DraftKings and FanDuel. And for the challenger brands, it’s clear that they’ll never surpass the market leaders by using their expensive playbook.

User acquisition costs need to come down. Lifetime values need to go up. We believe the key to achieving this will be activating content, community, and personalities within sports betting apps.

The Role of Content, Community, and Personalities in Online Sportsbooks

In 2020, sportsbooks used IP and personalities to acquire new users. But in 2021, operators must activate these content assets within the apps themselves in order to create a differentiated user experience that increases customer LTV by driving increased engagement, loyalty, and retention.

In 2020, most betting operator and content creator partnerships were purely awareness-based activations. Big ad buys, sponsorships, and endorsement deals designed to drive new signups by leveraging the reach and influence of media partners. This could be promotional offers for a “risk-free bet” for followers of a particular TV network, publisher, or personality. Or simply becoming “the official sportsbook” of a team or media entity. These tactics increase brand visibility in target markets, which translates to new users.

But it doesn’t translate to customer stickiness. Ultimately, it’s an approach that goes wide but thin.

And it can quickly create a losing cycle of promotion > signup > churn, because the customer’s loyalty to the promotional partner never fully transfers over to the sportsbook. I may sign up for DraftKings because I’m (unfortunately) a Knicks fan, and there’s DraftKings signage all over MSG, and they’re running a promotion for a risk-free bet on tonight’s game.

But then what?

I entered the door as part of a community, but inside I’m just another user. And DraftKings is just another sports betting app. So what’s keeping me there?

Dave Edwards, an EVP at marketing agency R3 Worldwide, explains how undifferentiated most betting platforms are:

“It’s hard for these sportsbook companies to differentiate themselves. Legally they’re really all the same, all regulated by the state and licensed.”

So in a highly commodified market like sports betting, it’s not enough to merely acquire customers. Online sportsbooks must also engage, delight, and retain them. Just as content, community, and personalities are key to bringing customers onto an app, they will also be key keeping them there.

John Levy, CEO of theScore, elaborates:

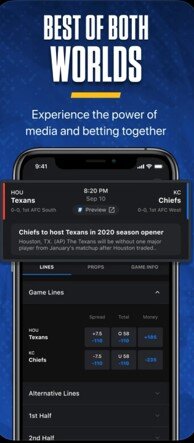

“When you stop thinking about betting as a transactional platform and start thinking about how people are excited about consuming, you can be creative with what you offer…Other social platforms take it [engagement] for granted, but sports betting platforms have been doing the same thing forever. This melding of media and betting will displace traditional things and shift old ways to new ways of thinking, and that’s exciting.”

In other words, gambling operators need to start operating like media companies. Not only will content-driven marketing significantly reduce user acquisition costs, but it will also dramatically improve lifetime values.

DECREASING CAC

Playline, a daily fantasy sports platform, highlights the marketing power of organic social content creators. The platform has cultivated a network of 500 influencers and community managers, paid via performance deals, to engage with Playline’s content. Playline even acquired a popular Instagram account, NBAMemes, to bolster this approach.

The result?

Playline boasts a $25 user acquisition cost. For context, some of the betting incumbents pay up to $500 per user.

Penn National Gaming (“PNG”) also dramatically lowered their customer acquisition costs by embracing organic digital content aimed at a passionate community. The company spent $136 million to acquire a 36% stake of Barstool Sports, and thus a direct line to its sports-hungry fanbase. In its Q3 report, PNG reported a “very limited external marketing spend” that enabled “organic customer acquisition…at a fraction of the cost of the traditional marketing efforts relied upon by many of our competitors”

This approach kept marketing costs down and improved the company’s valuation. Specifically, PNG realized a 2.8x YTD multiple expansion of EV / EBITDA, compared to competitors like MGM, whose EV / EBITDA decreased by 1x over the same period.

Of note, these improved economics didn’t come at the expense of user growth. Only a month after launching in Pennsylvania, the Barstool Sportsbook app achieved 13.4% market share.